Working with Gold IRA Companies

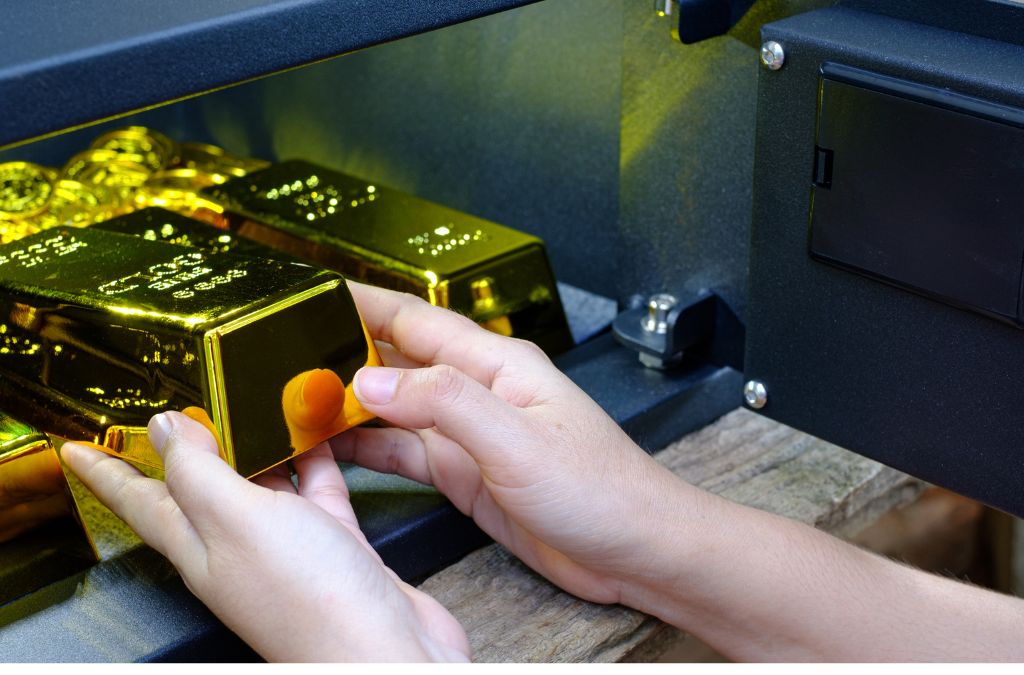

In an era marked by economic uncertainty and market volatility, lots of capitalists are looking for methods to safeguard their wide range. One significantly prominent choice is investing in a Gold Person Retirement Account (IRA). But just how do you choose the appropriate Gold IRA business? This short article works as a thorough overview on Gold IRA business, discovering their advantages, potential risks, and what to seek when picking one. A Gold individual retirement account is a specific type of self-directed Individual Retirement Account that enables you to invest in physical gold, silver, platinum, and palladium. Unlike typical Individual retirement accounts that commonly hold supplies or bonds, a Gold individual retirement account supplies a special opportunity to diversify your profile with tangible properties. Investing in gold can serve as a hedge versus inflation and market declines. Historic information recommends that gold commonly keeps its value when various other investments fail. For instance, throughout the 2008 economic situation, gold rates rose while securities market plummeted. Gold individual retirement account firms help with the buying, selling, and storage space of rare-earth elements within your retirement account. They aid navigate the intricacies of IRS guidelines controling rare-earth elements investments. By incorporating physical gold right into your retirement, you’re adding a layer of diversification that can alleviate threats related to stock market fluctuations. Gold has actually historically been deemed a safe-haven property throughout durations of inflation. In times when fiat money lose value, gold often tends to maintain its buying power. While previous performance isn’t a sign of future results, several capitalists have actually seen substantial gains from their gold holdings over time. Investing through a Gold individual retirement account enables tax-deferred growth up until withdrawals begin at retirement age. With self-directed IRAs, you have much more control over your financial investment decisions contrasted to conventional retirement accounts taken care of by economic institutions. When selecting from different Gold IRA companies, consider their years in business and track record amongst customers. Checking out reviews and endorsements can supply understandings right into client contentment levels. |Variable|Summary|| ————————-|———————————————-|| Years in Business|Longer experience typically indicates dependability|| Client Assesses|Positive responses reflects solution quality|| Regulatory Compliance|Adherence to internal revenue service regulations is important| Understand the charge structure prior to dedicating to any type of business. Look for hidden fees associated with configuration costs, storage fees, and transaction charges. Not all companies use the exact same choice of precious metals. Make certain that they supply IRS-approved bullion coins and bars. Compliance with internal revenue service regulations is vital for maintaining the tax obligation benefits connected with IRAs. Failing to abide can cause penalties or disqualification from tax-deferred status. Understanding how IRS regulations govern precious metals financial investments will assist you make informed choices about your Gold IRA account. Some business supply set apart https://goldiracompanies.substack.com/ storage space where your steels are kept separately from other clients’ holdings, while non-segregated storage space includes pooling assets together. Ensure that your selected company just uses IRS-approved depositories for keeping rare-earth elements safely. Evaluate just how available client support is– do they have phone support? Do they react promptly via email? An excellent firm should supply educational resources such as write-ups or webinars discussing numerous aspects of buying precious metals through IRAs. Be careful of firms promising impractical returns on investment; always carry out independent study prior to making decisions. Avoid companies that make use of high-pressure sales techniques; respectable firms will enable you time to make informed options without rushing you right into decisions. No, just specific types of gold bullion coins and bars approved by the IRS can be held in a Gold IRA. You can initiate a rollover by contacting your present pension supplier and asking for the transfer procedure; several Gold individual retirement account firms aid with this process too. Withdrawals are tired as ordinary earnings; however, if taken before age 59 1/2 might sustain added charges unless qualifying exceptions apply. No, if you select a self-directed Gold IRA, you’ll require to store your metals in an IRS-approved depository rather than keeping them at home. Most reputable business will help you in offering your rare-earth elements back at present market prices while ensuring conformity with tax obligation regulations as necessary. The setup procedure typically takes concerning 1-3 weeks depending upon how rapidly records are processed between parties involved. Choosing the best gold ira business is vital for safeguarding your riches throughout unstable times like these we face today! The appeal of buying tangible properties like gold draws in numerous people looking for security among financial turmoil; however diligence should be exercised! Take some time looking into various choices readily available while assessing their online reputations very carefully along with charge structures– this way you’ll make enlightened choices leading towards successful lasting savings strategies! In recap: By understanding what makes reputable companies stand apart versus those using dubious practices– you’ll equip yourself with knowledge needed not simply survive but grow financially regardless exterior pressures! So go on– take cost today! In recent years, transforming pension into gold-backed IRAs has gathered significant attention amongst financiers. With the economy’s volatility and inflation worries, many people are searching for means to protect their properties. But just how much does it cost to transform an individual retirement account to gold? This post looks for to provide a comprehensive review of this procedure, consisting of the linked expenses, benefits, and factors to consider involved. Converting an Individual Retirement Account (INDIVIDUAL RETIREMENT ACCOUNT) right into gold is a tactical step that can possibly use greater safety against market variations. But how do you navigate this conversion? When taking into consideration transforming your individual retirement account into gold, understanding the prices involved is essential. The prices can vary significantly depending upon various variables such as custodial costs, storage fees, and market conditions. Several elements can add to the general costs connected with transforming an IRA into gold: The price of gold itself is subject to fluctuations based on worldwide financial conditions and capitalist demand, affecting just how much you could spend during conversion. Different custodians have different charge structures; hence, investigating and comparing a number of choices before choosing one is vital for expense management. The kind of rare-earth elements you choose likewise plays a role in prices– gold bullion commonly has actually various expenses compared to collectible coins or various other forms of gold investments. Investing in gold through an individual retirement account offers several benefits: Gold commonly preserves its value better than standard currency throughout financial downturns. Adding physical assets like gold gives diversity which can mitigate risks associated with stock exchange investments. Gold IRAs use tax-deferred growth comparable to typical Individual retirement accounts up until you take out funds at retirement age. Physical properties such as gold provide even more safety and security compared to stocks and bonds that undergo market volatility. While there are benefits, it’s vital additionally to think about prospective downsides: The total expense connected with preserving a gold IRA can be more than traditional Individual retirement accounts due mostly to custodial and storage space fees. Selling physical gold can occasionally take longer than marketing protections; for that reason liquidity can become a problem if immediate cash money is needed. Navigating internal revenue service guidelines concerning rare-earth element investments calls for persistance and understanding; stopping working compliance gold ira funds could lead you down expensive paths. Here we deal with some regularly asked inquiries concerning just how much it costs and other aspects related to converting Individual retirement accounts into gold: A: You can convert Typical IRAs, Roth IRAs, SEP IRAs, and also certain employer-sponsored strategies right into a Gold IRA as long as they satisfy IRS guidelines. A: Normally no tax charges use if you carry out a straight transfer in between custodians without seizing funds on your own; however seeking advice from tax obligation experts is a good idea for tailored advice. A: No! The internal revenue service mandates that all rare-earth elements held within a specific retirement account should be kept in accepted vaults– not maintained home– to adhere to regulations fully. A: While liquidating is feasible with your custodian or dealership services offered by them, remember it might take some time compared with marketing conventional supplies or bonds due mostly due diligence needs tied up in those transactions! A: Not necessarily! The internal revenue service limits investments largely concentrating on details forms– including bullion coins like American Eagles & & Canadian Maple Leafs– while preventing antiques or numismatic coins under law guidelines! A: Definitely! Besides GOLD itself– you’re enabled access silver/platinum/palladium holdings as well– as long they comply with corresponding regulatory limits laid forth by controling bodies supervising retirement accounts! Converting an Individual Retirement Account (INDIVIDUAL RETIREMENT ACCOUNT) right into gold presents both possibilities and difficulties for investors seeking stability versus financial uncertainty. By completely understanding how a lot it costs each step along this journey– from configuration with ongoing upkeep– you’ll much better navigate this financial investment landscape while optimizing possible returns in time without dropping preyed on unanticipated challenges hiding behind corners! Remember constantly seek advice tailored particularly in the direction of specific demands before proceeding forward– after all spending intelligently today implies securing brighter tomorrows ahead! This detailed summary ought to offer you understanding not just into how a lot does it cost yet also direct you with what involves this conversion process effectively! In the realm of health and wellness and health, rest top quality plays an essential duty in healing and total wellness. Amongst the numerous compounds promoted for their prospective to boost rest, MK-677 stands out as a fascinating option. This article digs deep into how MK-677 can enhance rest top quality and recuperation, exploring its systems of action, benefits, possible negative effects, and much more. MK-677, additionally known as Ibutamoren, is a growth hormone secretagogue that simulates the action of ghrelin. Ghrelin is a hormone that promotes cravings and promotes the release of development hormonal agent (GH). Originally created to deal with muscle mass wasting problems, MK-677 has garnered focus for its capability to enhance rest high quality and help recovery among athletes and physical fitness enthusiasts. MK-677 features by binding to the ghrelin receptor in the brain. This interaction boosts the launch of growth hormonal agent from the pituitary gland, resulting in a cascade of physiological effects. It does not call for injection like typical growth hormonal agent treatments, making it an attractive option for many people looking to optimize their recovery processes. One of the primary advantages of MK-677 is its capacity to enhance endogenous growth hormonal agent levels. Elevated GH degrees contribute dramatically to muscular tissue mass retention, weight loss, and enhanced recuperation rates after strenuous exercise. Research shows that MK-677 influences various phases of sleep– especially enhancing slow-wave sleep (SWS) or deep rest. SWS is vital for physical recovery as it’s during this phase that the majority of fixing procedures occur in the body. Rapid Eye Motion (REM) rest is vital for cognitive functions such as memory debt consolidation. Some studies recommend that MK-677 may additionally advertise longer periods and much better quality REM sleep, therefore helping both psychological and physical recovery. Quality rest fosters muscle fixing via protein synthesis– a procedure vital for professional athletes aiming to recuperate from intense workouts. With enhanced deep rest assisted in by MK-677, people might experience much faster recuperation times and improved efficiency metrics. The secretion of numerous hormonal agents– including testosterone– occurs throughout different stages of sleep. By enhancing general rest top quality, MK-677 indirectly sustains hormonal equilibrium which is important for recovery. Consistent use of MK-677 can bring about raised muscle mass because of elevated development hormone degrees. This can be especially advantageous for bodybuilders or professional athletes aiming to boost their figure while recovering successfully from laborious workouts. While boosting muscle mass, https://benkou.substack.com/p/mk-677 MK-677 might additionally sustain fat loss by promoting a greater metabolic rate through boosted energy expenditure during rest. Though generally well-tolerated, some customers report negative effects such as boosted cravings, tiredness during daytime hours, or light lethargy upon waking up. Long-term effects are still under investigation; however, keeping an eye on GH degrees routinely when making use of MK-677 is advisable. Elevated degrees over extended durations can bring about unwanted adverse effects like insulin resistance or water retention. Typical dosages vary from 10mg to 25mg daily; nonetheless, individual actions can vary considerably based on individual health and wellness status and objectives. It’s wise to begin at a reduced dosage and progressively boost it while monitoring your body’s reaction closely. Taking MK-677 prior to going to bed can amplify its results on improving rest top quality because it aligns with all-natural hormone variations that take place throughout night-time remainder periods. Many users have reported substantial renovations in their total quality of life after integrating MK-677 right into their regimens: “I never ever thought I can really feel so rested after just one evening on MK-677! My exercises have actually significantly enhanced.” – Fitness Enthusiast In recap, understanding just how MK-677 boosts rest quality holds enormous worth not just for athletes however any person looking for ideal recovery approaches in life’s demanding rate. With proof aiming towards its capacity to enhance both deep and rapid eye movement– essential components for efficient healing– this substance could stand for a game-changer in your health and wellness arsenal. By using its prospective advantages properly while being aware of feasible adverse effects and correct use standards, you may simply find yourself enjoying considerable rewards in your mission for better health! This post envelops a substantial review of exactly how MK-677 improves sleep top quality and aids healing procedures through numerous mechanisms while supplying useful understandings right into its use factors to consider along with attending to regularly asked inquiries regarding this interesting compound. Investing in gold has long been considered as a safe house, specifically throughout financial chaos. With the increase in popularity of Gold IRAs (Person Retirement Accounts), people are finding more ways to expand their retirement profiles. Nevertheless, navigating the intricacies of Gold IRAs can be overwhelming, particularly worrying fees and expenses. One vital aspect that msn plays a significant duty in handling these expenses is the custodian. This article will certainly look into The Function of Custodians in Gold Individual Retirement Account Costs and Expenses, checking out everything from the essentials of custodianship to certain charges connected with Gold IRAs. Gold IRAs are specialized pension that enable capitalists to hold physical gold in addition to various other precious metals like silver, platinum, and palladium. Unlike traditional Individual retirement accounts, which generally hold paper assets like stocks and bonds, Gold IRAs use a concrete asset that can act as a bush versus inflation. Investors transform to Gold IRAs for several reasons: Custodians play an important part in managing your Gold IRA. They take care of different management tasks while making sure conformity with internal revenue service regulations. Their obligations can straight influence the overall costs and costs associated with your account. Custodians are in charge of: Custodial solutions generally feature their own collection of charges, which can dramatically impact your overall investment costs. Understanding these charges is crucial for any person taking into consideration a Gold IRA. When developing a Gold IRA, a lot of custodians charge a preliminary setup fee. This one-time cost can differ based on the monetary institution. Custodians normally charge a yearly upkeep cost to cover ongoing administrative costs. This charge commonly ranges from $100 to $300 annually. Whenever you buy or offer gold within your IRA, custodians may impose deal fees. These costs can be either flat rates or percentages based upon the overall deal amount. Gold has to be stored in an IRS-approved facility. Thus, custodians frequently bill storage costs for keeping your precious metals secure. Before choosing a custodian, it’s essential to research their online reputation within the industry. Search for reviews and testimonies from current customers. An excellent custodian ought to supply clear details concerning their fee structure upfront. Concealed charges can swiftly add up, adversely influencing your financial investment returns. Typical costs include setup charges, annual upkeep fees, transaction charges, and storage fees. Yes, you have the choice to transform custodians if you discover better rates or solutions elsewhere. Generally talking, custodial fees associated with your retirement account may be tax-deductible; nevertheless, seek advice from a tax consultant for individualized advice. Most credible custodians supply thorough charge routines on their web sites or upon request. While greater fees could imply far better solution and protection actions, it’s critical to evaluate whether those advantages justify the added price based on your individual financial investment strategy. Yes! A great custodian needs to aid you with comprehending IRS regulations pertaining to precious metal investments within an IRA. In summary, understanding The Duty of Custodians in Gold IRA Costs and Expenses is vital for any type of investor seeking to diversify their retired life portfolio through gold financial investments. From first arrangement expenses to continuous upkeep costs, custodians substantially influence how much you will ultimately pay over time. Selecting the appropriate custodian includes reviewing not just their charge structure but additionally their credibility and level of service offered. By making notified selections concerning both your investments and associated costs, you can effectively handle your funds while securing your future retirement objectives through gold investments. It’s essential constantly to read evaluations regarding different custodians before making a choice considering that they will straight impact both your experience as a financier and how much you’re investing in preserving your account with time! By investing intelligently today– with all this knowledge available– you’ll put yourself in an exceptional position for tomorrow! In today’s unpredictable monetary landscape, browsing economic unpredictability can seem like sailing via stormy seas without a compass. Numerous investors are on the birch gold group reviews lookout for dependable methods to secure their wide range versus rising cost of living, market volatility, and various other economic elements. One such method obtaining traction is buying precious metals, specifically gold. Amongst the various business supplying gold financial investment remedies, Birch Gold Team attracts attention as a trusted partner for people wanting to hedge against economic instability. In this substantial article, we will certainly look into the numerous elements of Navigating Financial Unpredictability with Birch Gold: Review Highlights, supplying insights right into its solutions, client experiences, and general effectiveness. Economic unpredictability describes the unpredictability surrounding financial conditions and potential customers. Aspects contributing to this unpredictability include rising cost of living prices, joblessness levels, geopolitical tensions, and central bank policies. Investors usually locate themselves questioning just how these variables will certainly influence their financial investments and savings. Investing in precious metals like silver and gold has long been taken into consideration a safe haven throughout tumultuous times. Unlike fiat money that can fluctuate extremely, rare-earth elements often tend to maintain their innate value. This security makes them an appealing choice for risk-averse investors. Founded in 2003, Birch Gold Team has constructed an online reputation as a sector leader in precious metal financial investments. The firm concentrates on aiding customers diversify their retired life profiles by consisting of physical gold, silver, platinum, and palladium. Birch Gold uses a well-shaped financial investment strategy that concentrates on informing customers concerning the advantages of diversifying their possessions with rare-earth elements. The company offers personalized consultations to help customers recognize how gold can suit their financial plans. One of the standout attributes of Birch Gold is its client-centric strategy. They focus on structure lasting relationships with clients by giving tailored suggestions and support throughout the investment process. Birch Gold prioritizes education by using a wealth of resources– such as webinars, articles, and overviews– to encourage capitalists to make enlightened decisions concerning their financial futures. Transparency is crucial when it comes to spending. Birch Gold preserves a clear pricing framework without covert costs or surprise costs. Customers appreciate understanding exactly what they’re paying for when buying precious metals. The team at Birch Gold consists of seasoned specialists that are well-informed about both the market and the products they supply. Their customer assistance is constantly appreciated by customers that commend their responsiveness and helpfulness. A vital component of recognizing any provider’s reputation depends on consumer endorsements. Numerous Birch Gold examines highlight positive customer experiences regarding smooth transactions and expert support throughout the financial investment process. Real-life success stories work as effective endorsements for potential capitalists. Lots of previous customers share how investing with Birch Gold allowed them to safeguard their riches during unpredictable economic periods successfully. While every evaluation tells a special tale, a number of common motifs arise: No company is without its doubters; nonetheless, unfavorable feedback relating to Birch Gold often tends to be reasonably limited contrasted to other firms in the exact same field. An usual worry amongst some customers consists of misunderstandings concerning fees or shipment timelines– which often come from miscommunication instead of systemic problems within the firm itself. Birch Gold uses a range of items that cater to various financial investment strategies: This diversity permits clients to tailor their portfolios based upon personal choices and market conditions. Birch Gold specializes not just in straight acquisitions however additionally in promoting Individual retirement accounts backed by physical precious metals– an attractive option for retired life planning. A self-directed IRA allows customers better control over their financial investments while taking pleasure in tax obligation benefits normal of retired life accounts. Clients generally begin their journey with an initial consultation where they discuss goals and assumptions with a professional advisor from Birch Gold Group. Once you choose your investment approach, establishing your account is simple thanks to structured procedures developed for ease-of-use. After your account is developed, you can acquire your desired steels swiftly– typically within simply one business day! Absolutely! Birch Gold has developed a strong online reputation over virtually 20 years as a credible carrier of rare-earth element investments. Yes! Birch Gold focuses on transforming traditional Individual retirement accounts right into self-directed IRAs backed by physical gold or various other metals without sustaining prompt tax obligation penalties. Birch Gold mostly supplies silver and gold but also offers choices for platinum and palladium investments. Consulting with among Birch Gold’s experts will certainly assist establish if including gold into your profile aligns with your financial objectives– particularly throughout uncertain times! No! Birch Gold prides itself on clear rates without hidden charges– ensuring that you know precisely what you’re spending for in all times! Birch Gold provides extraordinary continuous customer support– don’t hesitate to connect anytime you have concerns or need additional assistance! In summary, navigating financial unpredictability does not have to be frustrating when you have trusted companions like Birch Gold Team strolling along with you every action of the way. With comprehensive instructional sources, clear prices versions, varied investment options– consisting of self-directed IRAs– and significant client testimonies supporting its credibility– the company stands apart as an outstanding selection for any person seeking to secure their riches during turbulent financial times. So take control over your financial future today! Investing carefully can suggest weathering any tornado in advance– and maybe also prospering among it all! Mushroom coffee has taken the wellness globe by tornado, becoming a stylish superfood drink incorporating the very best of two popular globes– mushrooms and coffee. This cutting-edge drink assures not only to provide the cherished high levels of caffeine kick yet likewise improves your health and wellness with extraordinary benefits from medicinal mushrooms. Mushroom coffee is a mix of ground coffee beans and powdered medical mushrooms, such as lion’s hair, best mushroom coffee for weight loss chaga, reishi, and cordyceps. This distinct mixture offers a natural taste profile that raises typical coffee while offering a host of health and wellness advantages. If you’re trying to find an option to normal coffee or merely intend to improve your early morning regimen, mushroom coffee might be your response. It’s packed with anti-oxidants, vitamins, and minerals that can boost emphasis, increase resistance, and reduce anxiety levels. When venturing right into the realm of mushroom-infused drinks, selecting a reliable brand name is vital. Some of the very best mushroom coffee brand names include: Let’s dive deeper into why mushroom coffee is being hailed as the supreme superfood drink. Mushroom coffee can boost psychological clearness due to its blend of caffeine and adaptogenic residential or commercial properties from mushrooms like lion’s mane. These advantages usually lead to boosted focus and productivity. Medicinal mushrooms are understood for their immune-boosting residential or commercial properties thanks to their abundant antioxidant web content. Drinking mushroom coffee consistently might help repel illnesses. Adaptogens found in lots of kinds of mushrooms can help control anxiety responses in the body. This indicates less stress and anxiety and even more tranquility in everyday life. One typical issue concerning standard coffee is the jitters following consumption. The mix of mushrooms in this beverage assists create a smoother energy experience without the collision associated with routine caffeinated drinks. Making mushroom coffee in your home is simpler than you could believe! Below’s an easy dish: To understand what makes this drink so unique, allow’s damage down some nutritional elements: |Nutrient|Contribution from Mushroom Coffee|| ——————–|———————————-|| Antioxidants|High|| Vitamins B|Modest|| Vitamin D|Present (in certain mushrooms)|| Polysaccharides|Existing (improves immune feedback)| Mushroom coffee commonly includes numerous sorts of fungis understood for their wellness advantages: While the majority of people can appreciate mushroom coffee without issues, some might experience negative effects: Always consult with a doctor if you’re not sure regarding incorporating any type of brand-new food into your diet. The best way to take in mushroom coffee is to prepare it much like regular coffee– made warm or cold– while thinking about adding tastes that suit your palate. It depends on specific demands; nevertheless, numerous discover that mushroom coffee supplies continual power without anxieties as a result of its adaptogenic properties. Yes! Many brands currently offer instant packets or ready-to-drink options that include various blends of medical mushrooms combined with high quality coffees. Caffeine levels differ depending upon the brand; generally, they consist of much less high levels of caffeine than normal brewed coffee due to the addition of mushrooms which thin down concentration. Pregnant women need to consult their doctor prior to taking in any type of new items, consisting of mushroom coffees because of varying effects. You can acquire high-quality choices online with brand name sites or significant sellers like Amazon or health-focused stores. In this section, we’ll contrast both drinks across a number of variables: |Element|Conventional Coffee|Mushroom Coffee|| ——————-|—————————————-|—————————————–|| High levels of caffeine Degree|High|Modest|| Wellness Advantages|Restricted past basic antioxidants|Enhanced through medicinal residential or commercial properties|| Digestive Influence|May create level of acidity|Usually gentler on food digestion| Start Slow: If you’re brand-new to this superfood beverage, start with tiny amounts till you determine exactly how your body reacts. Experiment: Mix different sorts of mushrooms with diverse flavors until you discover what suits your palate best! Pair Wisely: Enjoy alongside healthy treats– think nuts or fruits– to optimize dietary consumption while sipping! Stay Hydrated: Make sure ample water intake throughout the day also when taking in these powerful brews. Mind Your Timing: Take into consideration having your cup in mid-morning as opposed to very first thing on a vacant belly for optimal results! As consumers become more conscious regarding where their food comes from, recognizing sustainability methods ends up being vital– specifically pertaining to growing techniques utilized for medicinal mushrooms found in these coffees: By supporting honest methods within food production chains– including our beloved superfoods– we contribute favorably in the direction of environmental preservation efforts! In conclusion, diving into the globe of mushroom-infused beverages could be among one of the most useful decisions you’ll ever before make concerning health-conscious choices! With various advantages ranging from boosted cognitive feature all while experiencing smoothened power levels– it’s no surprise why every person seems interested by this creative fusion! So why wait? Get on your own some top quality ingredients today! After all– Mushroom Coffee: The Ultimate Superfood Drink You Required to Try might effectively be just what you need! Retirement preparation is one of those important life tasks that typically gets pushed to the back heater till it’s practically too late. With the unpredictability of Social Safety and security, rising and fall stock markets, and rising living expenses, several individuals are looking for different methods to safeguard their financial futures. One such choice that has gotten substantial traction over the last few years is the Gold IRA. However exactly what is a Gold IRA, and why should you consider it? In this post, we’ll dive deep into the gold individual retirement account pros and cons, offering insights that will certainly assist you make an enlightened decision concerning whether this retirement straightens with your lasting goals. A Gold IRA (Person Retired life Account) allows financiers to hold physical gold as part of their retirement profile. Unlike traditional Individual retirement accounts, which usually consist of supplies, bonds, or mutual funds, a Gold IRA provides an opportunity to expand your financial investments by adding concrete properties right into the mix. This can be especially enticing offered the financial unpredictability and inflationary stress we face today. Before we delve into the gold individual retirement account pros and cons, it’s necessary to comprehend what a Gold IRA is. Basically, a Gold individual retirement account runs like any kind of other individual retired life account yet with one considerable difference: it allows for the financial investment in physical gold bullion or coins authorized by the internal revenue service. It’s important to note that not all gold items are eligible for a Gold individual retirement account. The IRS has set details requirements relating to purity and authenticity. The technicians behind a Gold individual retirement account are reasonably uncomplicated. You open up an account with a custodian who specializes in handling precious metals Individual retirement accounts. Once your account is established, you can fund it through payments or rollovers from other retirement accounts. After funding, you can buy physical gold with suppliers accepted by your custodian. One vital aspect of a Gold IRA is storage. The internal revenue service mandates that physical gold must be saved in an accepted vault rather than in your home or in personal property. This includes one more layer of safety and security but additionally incurs extra fees. Now allow’s discover a few of the benefits associated with buying a Gold individual retirement account: Gold has historically been considered as a safe haven during times of inflation. As prices rise and currency values change, gold typically preserves its worth far better than money or stocks. Investing in a Gold IRA permits you to diversify your portfolio significantly. In times when traditional investments underperform, having physical gold can buffer against losses. Similar to conventional IRAs, revenues on investments within a Gold IRA grow tax-deferred until withdrawal during retirement. Unlike supplies or bonds, having physical gold offers investors something concrete they can hold onto throughout economic declines or crises. Over years, gold has actually dawned to be steady compared to other asset classes– making it appealing for lasting financiers looking for security. Gold stays one of one of the most desired commodities worldwide because of its usages in precious jewelry production and innovation; for this reason its demand remains reasonably high despite market conditions. While there are numerous advantages related to Gold IRAs, prospective capitalists should also know the drawbacks: Setting up a Gold IRA normally sustains greater fees than conventional Individual retirement accounts because of custodian monitoring and storage costs. A key disadvantage is that you’re limited generally to precious metals; therefore you’re losing out on prospective gains from stocks or bonds. Although normally secure lasting, gold costs can still experience substantial temporary volatility influenced by worldwide financial events. Selling physical gold can occasionally take longer than selling off supplies or bonds since you’ll require to find buyers willing to pay market rates. Unlike dividend-paying stocks or interest-bearing bonds, physical gold does not produce capital– you count exclusively on cost gratitude for returns. Changes in guidelines concerning how precious metals can be held within pension might impact your financial investment approach relocating forward. If you have actually determined that purchasing a Gold IRA might line up with your retired life objectives after reviewing both sides– right here’s just how you deal with setting one up: Select an IRS-approved custodian experienced in managing rare-earth elements Individual retirement accounts who will certainly manage your acquisitions and storage gold ira pros and cons space needs effectively. |Custodian Call|Costs|Providers Provided|| —————-|——|——————|| Example Custodian 1|$250/year|Management & & Storage space|| Example Custodian 2|$300/year|Full-Service Monitoring| You can money your account through straight payments or rollovers from existing pension while adhering strictly to internal revenue service laws regarding limitations on payments annually. Once funded appropriately according to standards above– job carefully with your custodian on acquiring qualified types of bullion/coins under IRS rules! |Steel Type|Purity Needs|| ——————|——————————|| American Eagle|91% pure (22K)|| Canadian Maple Leaf|99.99% pure (24K)|| Austrian Philharmonic|99% pure (24K)| Your selected custodian will certainly set up storage within an approved facility where safety and security requirements make certain defense versus theft/loss! Here are some frequently asked inquiries bordering this financial investment automobile: Q1: Can I hold physical gold at home? No, you need to store any type of purchased metal within an approved vault per internal revenue service policies regulating these accounts! Q2: What are my withdrawal alternatives once I retire? You have options similar just like typical IRAs; including lump-sum distributions or regular withdrawals based upon private preferences! Q3: Exist fines for early withdrawal from my Gold IRA? Yes! Like normal pension– withdrawals taken before age 59 1/2 may sustain charges along with ordinary income tax responsibilities owed! Q4: Exactly how do I recognize if my chosen custodians are reputable? Research thoroughly online with reviews/testimonials while confirming credentials straight using regulatory bodies looking after economic services/products offered! Q5: What’s the minimum financial investment needed opening up one such account? Minimums vary extensively amongst custodians; talk directly when exploring potential partnerships before committing! Q6: Can I surrender funds from another sort of retirement plan right into my new GOLDIRA? Absolutely! As long as appropriate procedures complied with guaranteeing compliance throughout rollover procedure– you’ll be set! So there you have it– a comprehensive summary encapsulating whatever regarding “Gold IRAs Explained: A Take A Look At Their Pros and Cons for Retirement Planning”. While they use special benefits like diversity opportunities along with rising cost of living hedging abilities– it’s important always weigh these versus potential drawbacks such as high fees connected along liquidity difficulties entailed selling assets later down road when needed most! Eventually making educated decisions rooted securely based understanding subtleties bordering this fascinating investment automobile will certainly empower every investor making every effort toward securing satisfying future ahead! In today’s investment landscape, individuals are continuously looking for methods to diversify their portfolios and secure their financial futures. One such method gaining grip is the 401 k to Gold IRA rollover Yet just what does this entail? Why are so many capitalists taking into consideration gold as a crucial part of their retired life technique? In this detailed overview, we will certainly dig deep right into the myriad elements of 401k to Gold IRA rollovers, offering specialist insights that will brighten your understanding of this essential economic maneuver. A 401k strategy is a tax-advantaged retired life savings account sponsored by an employer. It enables workers to save and spend a part of their paycheck before taxes are gotten. This attribute helps individuals expand their financial savings with time via worsening interest. Contributions to a 401k are subtracted from a worker’s paycheck and bought numerous possessions, commonly including common funds, supplies, and bonds. Companies may additionally use matching payments as much as a certain percent, boosting the total cost savings possibility for employees. An Individual Retired life Account (INDIVIDUAL RETIREMENT ACCOUNT) is another sort of tax-advantaged financial investment account designed for retirement savings. Unlike a 401k, which is employer-sponsored, IRAs can be opened up independently by any individual. Gold has actually been revered as a linkedin store of worth for centuries. Its intrinsic worth and limited supply make it an appealing alternative during economic unpredictability or inflationary periods. Gold tends to perform well when traditional markets fail; its value frequently enhances during economic downturns or geopolitical tensions. A Gold individual retirement account is a self-directed Individual Retired life Account that enables capitalists to hold physical gold or other accepted rare-earth elements within it, as opposed to simply paper properties like supplies and bonds. Investing in a Gold individual retirement account comes with particular rules set forth by the internal revenue service concerning the types of metals enabled and exactly how they should be stored. A direct rollover commonly incurs no immediate tax obligation fines if done correctly; however, stopping working to adhere to IRS standards can bring about taxes and penalties. Diversifying one’s portfolio with gold can help minimize risks associated with market volatility and inflation. With rising prices deteriorating purchasing power, gold works as a reliable bush against inflationary pressures on fiat currencies. While gold can give stability during recessions, it’s not immune to price changes itself; understanding these risks is important before investing. Physical gold requires safe storage which can sustain additional fees throughout the investment period– considering these prices in advance is vital for planning purposes. |Function|Traditional individual retirement account|Gold IRA|| ————————-|————————–|—————————|| Property Types|Stocks, Bonds|Physical Rare-earth Elements|| Tax Treatment|Tax-deferred growth|Tax-deferred growth|| Needed Minimum Distributions|Yes|Yes|| Contribution Restrictions|$6,000 ($7,000 if over age 50)|Varies based on steel worth| Navigating through the complexities bordering the decision whether or not to execute a 401 k to Gold IRA rollover needs informed judgment and critical preparation. The change from conventional properties into concrete commodities like gold includes taking a look at individual financial goals alongside market conditions and potential threats connected with each financial investment type. By answering these inquiries truthfully, you’ll much better recognize whether this technique aligns with your long-lasting monetary objectives. You has to have left your work or gotten to old age; or else, you might face early withdrawal penalties on distributions taken prior to age 59 1/2 without rolling over into an additional certified account. If executed correctly through straight rollover techniques adhering strictly under internal revenue service laws– no penalties apply! Yes! You can surrender acquired funds from your deceased partner’s plan right into an existing or recently developed specific retired life account scot-free– as long as you adhere to appropriate procedures described by both strategies involved! While technically possible under particular conditions– most like utilizing third-party custodians who focus on safe and secure storage setups particularly tailored towards securing precious metals versus theft/damage! Consulting offered listings offered straight using custodial resources will certainly clarify which products fulfill internal revenue service requirements– they’ll aid better down roadway if needed! In conclusion, carrying out comprehensive research while evaluating all alternatives ahead serves vital relevance when contemplating surrendering any existing standard accounts in the direction of alternative financial investments like those provided with gold IRAs The insights shared within this guide target at empowering individuals looking towards securing their financial futures by leveraging historic possession classes in the middle of unpredictabilities surrounding modern-day industries– consisting of inflationary risks looming big today! So do something about it sensibly; make sure all decisions line up faultlessly along personal goals leading straight toward accomplishing best peace-of-mind come retired life day! In today’s fast-paced financial landscape, expanding your portfolio has actually become more vital than ever. The volatility of the stock market, rising cost of living worries, and geopolitical uncertainties have actually led capitalists to seek alternate avenues for riches preservation. One such avenue that has garnered considerable focus is gold. In this short article, we’ll explore Diversifying Your Profile: The Duty of Gold in Your 401(k) Rollover, supplying a thorough overview on how you can incorporate gold into your retired life strategy. A 401(k) plan is an employer-sponsored retirement savings account that enables employees to save a part of their income gross are taken out. It uses several benefits, including tax obligation benefits and potential employer matching contributions. While 401(k) plans give numerous advantages, they likewise include restrictions that can hinder efficient profile diversification: https://www.linkedin.com/pulse/401k-gold-ira-rollover-process-fees-tips-metals-resgoldira-xkfec/ Diversification is the method of spreading out financial investments throughout different asset courses to lower threat. By holding a mix of asset types, like stocks, bonds, and assets, capitalists can safeguard themselves from substantial losses. When it concerns diversity, gold provides one-of-a-kind benefits: Over the years, gold has shown to be a reputable shop of value. As an example: This historic performance emphasizes gold’s possibility as a long-term investment. Investors can choose from numerous forms when taking into consideration gold as component of their portfolio: A Gold IRA (Individual Retirement Account) permits investors to hold physical rare-earth elements like gold within their pension. This kind of account offers all the tax obligation advantages related to conventional IRAs while making it possible for diversity into tangible assets. To transfer properties from a typical 401(k) to a Gold individual retirement account includes numerous steps: Before proceeding with any type of rollover process: Finding the ideal custodian is crucial for managing your Gold individual retirement account efficiently: Not all forms of gold get inclusion in an individual retirement account; nevertheless, a number of types do: Certain types can not be held in an IRA: When establishing a Gold IRA account, custodians commonly bill configuration charges ranging from $50 to $300 depending on the firm’s rates structure. Expect yearly upkeep costs varying from $100 to $400 based on account size and services supplied by the custodian. One significant benefit is surrendering funds directly between accounts without causing taxable occasions as long as you’re certified with IRS guidelines regarding rollovers. Failure to comply with these standards could cause charges or tax obligations on very early withdrawals (commonly those taken prior to age 59 1/2). While often seen as secure contrasted to supplies during slumps, gold prices can still exhibit volatility affected by different elements such as mining output or geopolitical events. Physical storage space postures difficulties including security problems or insurance coverage expenses which need factor to consider when investing heavily in tangible properties like bullion bars or coins. Financial experts typically advise allocating around 5% – 10% towards precious metals within one’s total financial investment method based on personal threat resistance goals paired along with age demographic factors affecting retired life timelines up ahead! Conduct periodic testimonials evaluating how well diversified profiles stay ensuring positioning continues to be undamaged in the direction of altering economic landscapes over time! A1: Yes! You can buy silver, platinum, and palladium alongside gold within an approved Rare-earth element IRA setup! A2: Normally speaking most custodians impose minimum acquisition limitations though these differ so always seek advice from particular companies beforehand! A3: Research online directories like Better Company Bureau (BBB), consumer testimonial sites guaranteeing they lug high scores reflecting credible transactions! A4: If needed you might consider offering via dealerships or liquidating selling at dominating market rates depending upon scenarios determining timing choices made! A5: No! People regardless age group may finish rollovers relevant within defined contribution plans without constraint preventing access! A6: It’s wise carrying out analyses at the very least as soon as each year factoring transforming financial conditions along with individual scenarios influencing life phases coming close to future years ahead! Incorporating gold right into your retired life preparing via techniques like executing a successful 401 k to gold individual retirement account rollover provides an exceptional possibility for improving diversification while protecting versus financial uncertainties! Nonetheless it’s essential performing thorough research study paired together with cautious analyses lining up individual goals making sure all activities taken reflect well-informed decisions leading towards achieving long-lasting monetary security down life’s winding road ahead! In the modern financial landscape, where countless financial investment alternatives are plentiful, consumers are significantly trying to find credible companies to partner with. One such company that has gathered interest is Birch Gold Team, known for its focus on rare-earth elements and self-directed pension. Yet what collections Birch Gold apart in this crowded market? One vital component is transparency This short article delves into The Duty of Openness in Birch Gold’s Client Reviews, taking a look at how it affects client depend on, contentment, and total reputation. Transparency in organization describes the visibility and clearness with which a company communicates with its customers. It incorporates every little thing from pricing structures and item offerings to customer care methods. Transparent organizations typically share information readily, helping consumers make notified decisions. Customer reviews work as a representation of a firm’s integrity and performance. Companies like Birch Gold that prioritize transparency frequently get more positive testimonials. Birch Gold’s transparency enables prospective clients to see real feedback from existing clients. This credibility can dramatically boost credibility. At the heart of Birch Gold’s consumer interactions exists openness. By being open concerning costs, procedures, and also prospective threats connected with investing in precious metals, they grow an environment where clients feel safe and secure and informed. When you study Birch Gold Reviews, an usual style arises: clients value the firm’s simple approach. Allow’s break down some usual views shared by reviewers. Despite the favorable comments, no company is ideal. Evaluating critical reviews offers understandings into locations where Birch Gold might improve. A transparent method suggests not just sharing excellent news yet additionally addressing issues increased by consumers sincerely and promptly. By reacting constructively to adverse testimonials, Birch Gold demonstrates its commitment to client fulfillment: One significant benefit of maintaining transparency is cultivating long-lasting partnerships with consumers who feel valued and understood. The economic market is unstable; consequently, clear interaction becomes much more vital during challenging times. During considerable market changes, Birch Gold assures its customers via: In an industry raging with apprehension towards investment company, trust fund stemmed from openness can be a game-changer for companies like Birch Gold Group. Trust leads to higher retention rates, positive word-of-mouth recommendations, and inevitably development in customers– developing a great deal for both celebrations involved. Social evidence– such as endorsements or user-generated content– plays an essential role in establishing trustworthiness for services like Birch Gold Group. Birch Gold makes use of offered testimonials tactically by sharing positive reviews on their web site or social media systems which strengthens their dedication to transparency while showcasing completely satisfied clients’ stories. Q1: Why do consumer evaluations matter?Gold Individual Retirement Account Companies: Protecting Your Riches in Rough Times

Understanding Gold IRA Companies

What is a Gold IRA?

Why Consider Buying Gold?

The Function of Gold IRA Companies

Benefits of Using Gold Individual Retirement Account Companies

1. Diversity of Assets

2. Protection Versus Inflation

3. Potential for High Returns

4. Tax obligation Advantages

5. Control Over Investments

Choosing the Right Gold IRA Company

1. Experience and Reputation

Table: Aspects Influencing Company Reputation

2. Costs Structure

Common Sorts of Costs:

3. Option of Valuable Metals

Popular IRS-Approved Metals:

Gold individual retirement account Companies: Guarding Your Wealth in Turbulent Times Via Regulatory Compliance

Importance of IRS Regulations

How Do Rules Impact Your Investment?

Storage Choices Used by Gold Individual Retirement Account Companies

1. Set Apart Storage vs Non-Segregated Storage

2. Authorized Storage Facilities

Customer Service Evaluation When Selecting Gold IRA Companies

1. Availability and Assistance Channels

2. Educational Resources

Common Pitfalls When Dealing with Gold Individual Retirement Account Companies

1. Deceptive Info on Returns

2. High Pressure Sales Tactics

Frequently Asked Questions (Frequently asked questions)

1. Are all types of gold eligible for my Gold IRA?

2. Exactly how do I roll over my existing retirement account right into a Gold IRA?

3. What are the tax ramifications when taking out from my Gold IRA?

4. Can I literally hold my gold investment?

5. What takes place if I wish to liquidate my gold holdings?

6. How much time does it require to establish a Gold IRA?

Conclusion

How Much Does It Cost to Convert an Individual Retirement Account to Gold? A Comprehensive Review

Introduction

How to Transform IRA to Gold?

Understanding the Process

How Much Does It Price to Convert an IRA to Gold? A Comprehensive Overview

Cost Breakdown of Converting an IRA to Gold

1. Custodial Costs:

2. Setup Fees:

3. Transaction Costs:

4. Storage Charges:

5. Insurance Expenses:

6. Market Costs of Gold:

Factors Affecting Prices When Converting an Individual Retirement Account To Gold

Market Conditions

Custodian Selection

Type of Precious Metals

Benefits of Transforming an Individual Retirement Account to Gold

1. Hedge Versus Inflation:

2. Portfolio Diversity:

3. Tax Advantages:

4. Security and Stability:

Drawbacks of Converting an IRA To Gold

1. Higher Fees:

2. Liquidity Concerns:

3. Regulatory Conformity:

FAQs Regarding Transforming an Individual Retirement Account To Gold

Q1: What sorts of accounts can I exchange a Gold IRA?

Q2: Exists any type of tax obligation fine when transforming my traditional individual retirement account right into a Gold IRA?

Q3: Can I keep my physical gold at home?

Q4: What occurs if I desire out? Can I liquidate my holdings easily?

Q5: Are all types of rare-earth elements qualified for addition in my GOLD-IRA?

Q6: Can I include other possessions besides just GOLD within my newly transformed account?

Conclusion

How MK-677 Boosts Rest Top Quality and Healing

Introduction

What is MK-677?

The Science Behind MK-677

Mechanism of Action

Role in Development Hormonal agent Secretion

How MK-677 Enhances Sleep Quality

Impact on Sleep Architecture

Improving rapid eye movement Sleep

The Connection Between Rest Top Quality and Recovery

Sleep’s Duty in Muscular tissue Recovery

Hormonal Balance Throughout Sleep

Benefits of Utilizing MK-677 for Recovery

Enhanced Muscle Growth

Improved Fat Loss

Potential Adverse effects of MK-677

Common Side Effects

Long-term Usage Considerations

Dosage Suggestions for Optimum Results

Suggested Dose Guidelines

Timing Matters: When Should You Take It?

User Experiences: Testimonials on Sleep Enhancement

FAQs Concerning Just how MK-677 Enhances Sleep Top Quality and Recovery

Conclusion

** The Function of Custodians in Gold Individual Retirement Account Fees and Costs **.

Introduction

What Are Gold IRAs?

Understanding Gold IRAs

Why Think about a Gold IRA?

The Function of Custodians in Gold IRA Costs and Expenses

What Does a Custodian Do?

How Do Custodians Effect Fees?

Types of Custodial Costs Associated with Gold IRAs

Setup Fees

Annual Maintenance Fees

Transaction Fees

Storage Fees

Choosing the Right Custodian for Your Gold IRA

Reputation Matters

Transparent Cost Structure

Common Inquiries About Custodian Fees and Expenses

1. What are regular expenses associated with a Gold IRA?

2. Can I transform my custodian after opening my Gold IRA?

3. Are custodial fees tax-deductible?

4. How do I find out what my custodian charges?

5. Is it worth paying higher custodial costs for far better service?

6. Will certainly my custodian help me with IRS compliance?

Conclusion: Weighing Prices Versus Benefits

Browsing Financial Uncertainty with Birch Gold: Testimonial Emphasizes

Introduction

Understanding Economic Uncertainty

What is Economic Uncertainty?

Why Invest in Precious Metals?

Birch Gold Team: An Overview

Navigating Financial Uncertainty with Birch Gold: Evaluation Highlights

Comprehensive Investment Strategy

Client-Centric Approach

Educational Resources

Transparent Pricing Structure

Expert Personnel & Customer Support

Exploring Birch Gold Reviews

Customer Testimonials

Case Researches: Success Stories from Actual Clients

Common Themes in Reviews

Addressing Adverse Feedback

How Does Birch Gold Stand Out?

Diverse Financial investment Options

401(k) & individual retirement account Services

Self-Directed individual retirement account Accounts

Your Trip with Birch Gold: What to Expect?

Initial Appointment Process

Setting Up Your Account

Investment Purchase

Frequently Asked Questions (Frequently asked questions)

1. Is attaching Birch Gold safe?

2. Can I convert my existing IRA right into a precious metal IRA?

3. What types of precious metals does Birch Gold offer?

4. How do I recognize if purchasing gold is right for me?

5. Are there any kind of covert costs related to spending via Birch Gold?

6. What needs to I do if I have questions after my investment?

Conclusion

Mushroom Coffee: The Ultimate Superfood Drink You Required to Try

What is Mushroom Coffee?

Why You Need to Consider Attempting Mushroom Coffee

The Best Mushroom Coffee Brands You Need to Know

Top Advantages of Mushroom Coffee

Enhanced Cognitive Function

Boosts Immune System

Reduces Stress and anxiety Levels

Improves Energy Degrees Without Jitters

How to Prepare Your Own Mushroom Coffee at Home

Mushroom Coffee: The Ultimate Superfood Drink You Required to Try– Nutritional Breakdown

Different Types of Mushrooms Utilized in Coffee Blends

Potential Adverse effects of Mushroom Coffee

FAQs About Mushroom Coffee: The Ultimate Superfood Drink You Need to Try

1. What is the best method to consume mushroom coffee?

2. Is mushroom coffee better than routine coffee?

3. Can I find pre-made options?

4. Just how much high levels of caffeine does mushroom coffee contain?

5. Is it secure for expecting women?

6. Where can I acquire top quality mushroom coffee?

Mushroom Coffee vs Conventional Coffee: A Relative Analysis

Incorporating Mushroom Coffee Into Your Diet: Tips & Tricks

Sustainability Facets Surrounding Mushroom Farming

Conclusion

Gold IRAs Explained: A Check Out Their Pros and Cons for Retired Life Preparation

Introduction

Gold IRAs Clarified: A Consider Their Benefits And Drawbacks for Retirement Planning

What is a Gold IRA?

Types of Gold Allowed in a Gold IRA

How Does a Gold Individual Retirement Account Work?

Custodians and Storage

The Pros of Purchasing a Gold IRA

1. Hedge Versus Inflation

2. Diversification Benefits

3. Tax obligation Advantages

4. Tangible Asset Ownership

5. Long-Term Stability

6. International Need for Gold

The Disadvantages of Buying a Gold IRA

1. High Charges Related To Configuration and Maintenance

2. Limited Financial Investment Options

3. Market Volatility Risk

4. Potential Liquidity Issues

5. No Capital Generation

6. Governing Risks

How to Establish Your Own Gold IRA? Step-by-Step Guide

Step 1: Pick Your Custodian

Step 2: Fund Your Account

Step 3: Acquisition Your Valuable Metals

Eligible Metals Table:

Step 4: Secure Storage Arrangements

FAQs About Gold IRAs

Conclusion

Specialist Insights: What You Required to Learn About 401k to Gold Individual Retirement Account Rollovers

Introduction

Understanding the Fundamentals of 401k Plans

What is a 401k Plan?

How Does a 401k Work?

Key Benefits of a 401k Plan

What is an IRA?

Exploring Individual Retirement Accounts (INDIVIDUAL RETIREMENT ACCOUNT)

Types of IRAs

The Surge of Gold as an Investment

Why Gold?

Historical Performance of Gold

What is a Gold IRA?

Defining the Gold IRA

Regulations Controling Gold IRAs

The Refine of Rolling Over Your 401k into a Gold IRA

Step-by-Step Guide on 401k to Gold IRA Rollover

Tax Ramifications of Rollover

Benefits of 401k to Gold Individual Retirement Account Rollovers

Diversification Advantages

Hedge Against Inflation

Risks Connected with Purchasing Gold IRAs

Market Volatility

Storage Costs

Comparative Analysis: Conventional vs. Gold IRAs

Expert Insights: What You Required to Learn About 401k to Gold Individual Retirement Account Rollovers

Key Factors to consider Prior to Rolling Over:

Frequently Asked Inquiries (FAQs)

What receives a 401(k) rollover?

Are there charges for surrendering my 401(k)?

Can I surrender my partner’s 401(k)?

Is physical property allowed with my new gold ira?

How do I pick which rare-earth elements go into my ira?

Conclusion

Diversifying Your Portfolio: The Function of Gold in Your 401( k) Rollover

Introduction

Understanding 401(k) Strategies and Their Limitations

What Is a 401(k) Plan?

The Limitations of Standard 401(k) Plans

The Value of Diversification

Why Diversification Matters

Benefits of Branching out with Gold

Gold as a Financial investment Option

Historical Performance of Gold

Different Forms of Gold Investments

Understanding the 401k to Gold IRA Rollover

What Is a Gold IRA?

How Does a 401k to Gold IRA Rollover Work?

Steps for Executing a Successful Rollover

Evaluate Your Current Financial Situation

Research Possible Custodians

Types of Precious Metals Allowed in IRAs

Eligible Rare-earth elements for IRAs

Non-Compliant Precious Metals

Evaluating Expenses Related to Gold IRAs

Initial Arrangement Fees

Ongoing Maintenance Fees

Tax Ramifications When Rolling Over to a Gold IRA

Understanding Tax-Free Rollovers

Penalties for Non-Compliance

Potential Risks Entailed With Purchasing Gold

Market Volatility

Storage Concerns

Tips for Incorporating Gold right into Your Profile Strategy

Allocate Wisely

Regularly Testimonial Holdings

FAQs Concerning Diversifying Your Profile with Gold

Q1: Can I consist of other precious metals besides gold in my IRA?

Q2: Is there any type of minimum investment required?

Q3: How do I locate credible suppliers for acquiring physical bullion?

Q4: What occurs if I desire access to my physical gold?

Q5: Exist any type of age constraints associated especially towards rolling over funds right into an existing Individual Retired life Account?

Q6: How frequently should I rebalance my portfolio?

Conclusion

The Function of Transparency in Birch Gold’s Client Reviews

Introduction

Understanding Openness in Business

Why is Transparency Important?

The Influence of Transparency on Client Reviews

Establishing Integrity via Reviews

The Function of Transparency in Birch Gold’s Client Reviews

Key Facets of Openness at Birch Gold

Analyzing Birch Gold Reviews

Positive Comments: What Clients Are Saying

Areas for Enhancement Based on Reviews

Common Issues Increased by Customers

The Value of Addressing Customer Concerns

How Birch Gold Responds to Criticism

Building Long-Term Relationships with Transparency

Strategies for Enhancing Relationships

Navigating Market Challenges with Openness

How Birch Gold Handles Market Fluctuations

Trust as an Affordable Advantage

How Trust Converts into Business Success

The Function of Social Proof

Utilizing Testimonials Effectively

FAQs Regarding Openness and Consumer Evaluations at Birch Gold

A1: Customer reviews give understanding right into a firm’s efficiency from genuine users’ perspectives; they aid possible buyers make informed choices based on shared experiences.

Q2: How does openness impact customer loyalty?

A2: Business that keep transparency construct stronger relationships with their clients; this typically converts right into increased commitment over time as trust grows in between both parties involved.

Q3: Are there any unfavorable elements highlighted in Birch Gold reviews?

A3: Yes, some customers have mentioned concerns such as slow shipping times or intricacies within specific procedures however these problems are usually resolved constructively by the firm itself.

Q4: What steps does Birch take in the direction of enhancing based on feedback?

A4: They proactively motivate customer feedback via studies or straight interaction networks; this helps them identify locations needing improvement while also demonstrating their dedication in the direction of satisfying clients’ requirements effectively!

Q5: Is there instructional material available?

A5: Absolutely! BirchtGold gives different resources covering topics associated with rare-earth element investments– additional enhancing understanding amongst current/potential investors alike!

Q6: Can I discover unbiased viewpoints on the internet concerning my experiences?

A6: Indeed! Sites like Trustpilot or BBB host independent assessments allowing prospective financiers gain access to detailed insights prior to deciding whether or not seek business involvements further!

Conclusion

In final thought, openness plays a critical duty in shaping customer experiences at Birch Gold Team. By focusing on visibility across all elements– from pricing frameworks to communication– the company effectively cultivates a setting for trust-building among its customers. As we explored throughout this post on The Role of Openness in Birch Gold’s Consumer Reviews, it becomes noticeable that not just does this strategy positively affect individual assumptions however additionally acts as a keystone upon which long-term partnerships can be built within today’s ever-evolving monetary marketplace!

-

Table of Contents

The Benefits of Working with Top Gold IRA Companies

Investing in a Gold Individual Retirement Account (IRA) has become an increasingly popular strategy for those looking to diversify their retirement portfolios. Gold IRAs offer a unique blend of stability and growth potential, making them an attractive option for many investors. This article explores the benefits of working with top Gold IRA companies and how they can help you achieve your financial goals.

Expert Guidance and Support

One of the primary advantages of partnering with a reputable Gold IRA company is the expert guidance and support they provide. These companies employ experienced professionals who understand the intricacies of the gold market and can offer valuable insights to help you make informed decisions.

- Personalized investment strategies tailored to your financial goals

- Access to market research and analysis

- Assistance with the setup and management of your Gold IRA

For example, companies like Augusta Precious Metals and Goldco have built strong reputations for their customer service and expertise. Their advisors work closely with clients to develop customized investment plans that align with their retirement objectives.

Diversification and Risk Management

Investing in a Gold IRA allows you to diversify your retirement portfolio, which can help mitigate risk. Gold has historically been a safe-haven asset, often performing well during periods of economic uncertainty. By including gold in your portfolio, you can reduce your exposure to market volatility and protect your wealth.

- Gold’s inverse relationship with traditional assets like stocks and bonds

- Hedge against inflation and currency fluctuations

- Long-term stability and growth potential

For instance, during the 2008 financial crisis, gold prices surged as investors sought refuge from the collapsing stock market. This demonstrates the value of having gold as part of a diversified investment strategy.

Tax Advantages

Gold IRAs offer several tax benefits that can enhance your overall investment returns. Contributions to a traditional Gold IRA are typically tax-deductible, while earnings grow tax-deferred until you begin taking distributions in retirement. This can result in significant tax savings over time.

- Tax-deferred growth on investment earnings

- Potential tax deductions on contributions

- Roth Gold IRAs offer tax-free withdrawals in retirement

For example, if you contribute $5,000 to a traditional Gold IRA and your investment grows to $10,000 over time, you won’t pay taxes on the earnings until you withdraw the funds. This allows your investment to compound more effectively.

Secure Storage and Insurance

Top Gold IRA companies provide secure storage solutions for your precious metals, ensuring that your investments are protected. These companies partner with reputable depositories that offer state-of-the-art security measures and comprehensive insurance coverage.

- Segregated storage options for added security

- Fully insured storage facilities

- Regular audits and inventory checks

For instance, companies like Birch Gold Group and Regal Assets work with trusted depositories such as Delaware Depository and Brinks Global Services. These facilities offer high-level security and insurance, giving you peace of mind that your investments are safe.

Transparent Pricing and Fees

Working with a top Gold IRA company ensures that you receive transparent pricing and fee structures. These companies are committed to providing clear and upfront information about the costs associated with your investment, helping you avoid hidden fees and unexpected expenses.

- Clear breakdown of setup and maintenance fees

- Competitive pricing on gold and other precious metals

- No hidden charges or surprise costs

For example, companies like Noble Gold and Advantage Gold are known for their transparency and commitment to customer satisfaction. They provide detailed information about their fees and pricing, allowing you to make informed decisions about your investments.

Reputation and Trustworthiness

Partnering with a reputable Gold IRA company ensures that you are working with a trustworthy and reliable provider. These companies have established strong track records and positive customer reviews, giving you confidence in their ability to manage your investments effectively.

- Positive customer testimonials and reviews

- High ratings from industry watchdogs like the Better Business Bureau (BBB) and Trustpilot

- Strong industry reputation and longevity

For instance, companies like American Hartford Gold and Oxford Gold Group have received high ratings from the BBB and Trustpilot, reflecting their commitment to customer satisfaction and ethical business practices.

Educational Resources and Tools

Top Gold IRA companies often provide a wealth of educational resources and tools to help you make informed investment decisions. These resources can include articles, webinars, and interactive tools designed to enhance your understanding of the gold market and retirement planning.

- Comprehensive guides and articles on Gold IRAs

- Webinars and seminars hosted by industry experts

- Interactive tools for portfolio analysis and planning

For example, companies like Lear Capital and Rosland Capital offer extensive educational materials on their websites, helping investors stay informed and make better decisions about their retirement portfolios.

Conclusion

Working with top Gold IRA companies offers numerous benefits, from expert guidance and support to secure storage and transparent pricing. By partnering with a reputable provider, you can diversify your retirement portfolio, manage risk, and take advantage of tax benefits. Additionally, these companies offer valuable educational resources and tools to help you make informed investment decisions. Ultimately, choosing a top Gold IRA company can help you achieve your financial goals and secure a more stable and prosperous retirement.